philadelphia wage tax rate

The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. TAX DAY NOW MAY 17th - There are -388 days left until taxes are due.

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Census Bureau Number of municipalities and school districts that have local income taxes.

. The income tax is a flat rate of 307. 2021 Wage Tax Rate Summary for Pennsylvania. SIT rates for residents have been increased to 38712 percent for.

Print Full 2022 Payroll Tax Alert PDF. 307 Median household income. All Philadelphia residents owe the City Wage Tax regardless of where they work.

City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia. SIT rates for residents have been increased to 38712 percent for. What is Philadelphia city wage tax 2019.

Philadelphia Wage Tax Refunds Whats New for 2020. Philadelphias 13998 property tax rate of which 55 goes to the school district and 45 to the city is lower than most local governments. Non-residents who work in Philadelphia must also pay the Wage Tax.

City of Philadelphia Wage Tax. Its wage tax rate 38398 for city residents and 34481 for people who work in the city but live outside of it is the highest among big cities. 2021-2022 Wage Tax Rates for the City of Philadelphia As of July 1 2021 2021-2022 Current Year.

The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non-residents respectively. To use our Pennsylvania Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

When Councilmember Domb expanded the Wage Tax reimbursement rate it was estimated that it could help as many as 60000 households access tax refunds if they apply impacting the lives of 140000 individuals. Your employer withholds the Wage Tax from your paycheck and remits it to the City on your behalf. Report wage theft violation.

The Earnings Tax is self-pay and file if your employer doesnt collect and pay the Wage Tax for you you need to file and pay for yourself. The tax was made possible by the Sterling Act a Depression-era state law that allowed the city to earn revenue by passing special taxes. Wage Tax employers Due date.

The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer. The rate for residents remains unchanged at 38712. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481.

45 percent on transfers to direct descendants and lineal heirs. This program could amount to about 25 million going directly back to our working poor in Philadelphia. Employers must begin withholding Wage Tax at the new rate from all paychecks issued to residents and.

Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. The city of Philadelphia increased its wage tax rate for nonresidents to 35019 from 34481 effective July 1 2020 the citys revenue department said on its website. Start filing your tax return now.

Paychecks issued by employers that operate in the city must apply the new tax rate to all wage payments issued to nonresident employees with a pay date after June 30 2020 the city said in a news. Pennsylvania income tax rate. Residents making 100 an hour have the same 38398 wage tax rate as those making the 725 minimum wage.

News release City of Philadelphia June 30 2020 Similarly the Philadelphia nonresident Earnings Tax and Net Profits Tax NPT also increase effective July 1 2020 to 35019 with the resident rate remaining at 38712. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. View more rates on our Federal Payroll Tax Update page.

Effective July 1 2020 tax rates are 38712 for Philadelphia residents and 35019 for nonresidents. The wage tax grew over time reaching its highest rate of 496 percent for residents in 1985. For non-residents the Wage Tax applies to compensation for work or services.

What is Philadelphia city wage tax 2019. The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non-residents respectively. Determine home value and.

Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent. The Earnings Tax closely resembles the Wage Tax with the primary. Detailed Pennsylvania state income tax rates and brackets are available on this page.

15 percent on transfers to other heirs except charitable organizations exempt. In 1939 Philadelphia became the first city nationwide to implement a wage tax at a rate of 15 percent. 2021-2022 Wage Tax Rates for the City of Philadelphia As of July 1 2021 2021-2022 Current Year.

Wage Tax employers Get a tax account. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. This data represents changes in the prices of all goods and services purchased for consumption by urban households.

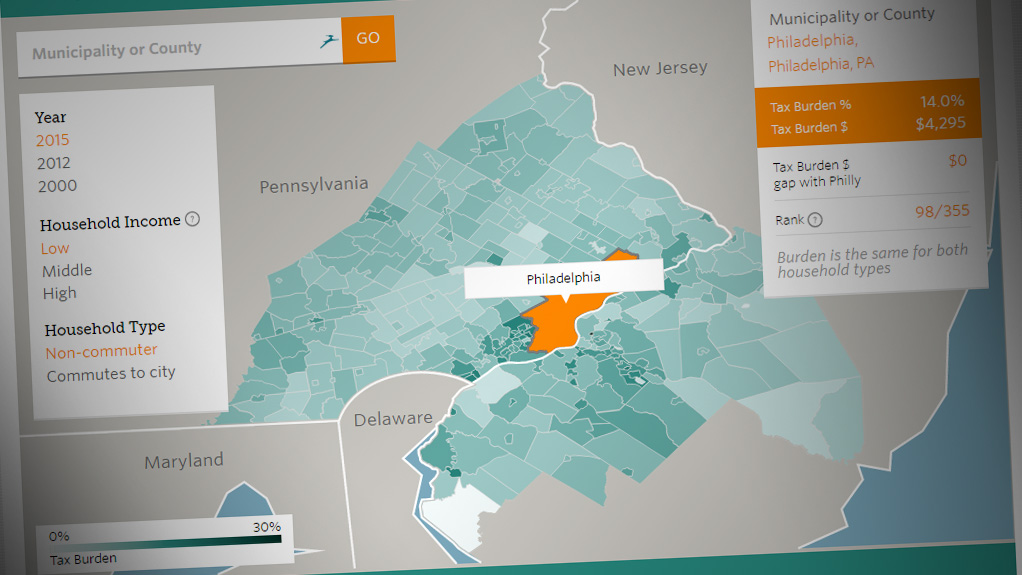

And that flat rate on the wage tax as well as the 307 state income tax helps give Philadelphia one of the nations highest state and local tax burdens on low-income households according to an annual study by the District of Columbia. 12 percent on transfers to siblings. See below to determine your filing frequency.

Inheritance and Estate Tax. Enter the number of children zip code and number of years of experience. The City of Philadelphia announced that effective July 1 2020 the Wage Tax rate for nonresidents is 35019 an increase from the previous rate of 34481.

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

2020 Year End Tax Planning Guide Tax Attorney Newyear How To Plan

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Philadelphia City Council Unveils 5b Budget Whyy

Philly Wage Tax To Be Lowered In New City Proposal Whyy

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

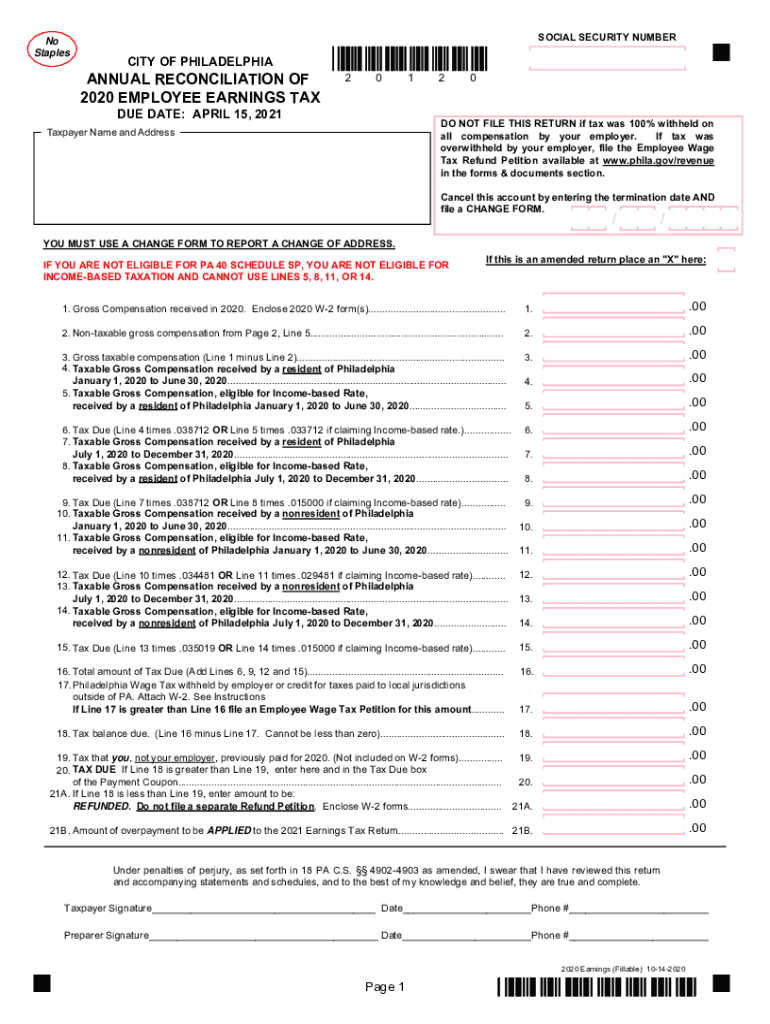

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

2020 Philadelphia Tax Rates Due Dates And Filing Tips

3355 Mary St Drexel Hill Philadelphia Real Estate Drexel Hill Real Estate

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Philly Councilmembers Unveil Proposal To Tax Philly S Ultra Rich